Our Commitment to Climate Risk Reduction

Sustainability is now the prudent and responsible default option for everyday investors.

Sustainability-focused investors now regard greenhouse gas emissions as the most important variable when it comes to climate impact. That’s why we’re enthusiastic supporters of the fossil fuel divestment movement.

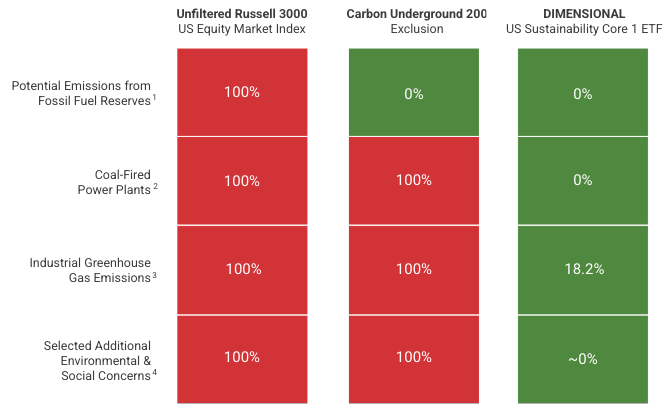

Divestment campaigns across the globe are using The Carbon Underground 200 as the definition for “fossil fuel companies” in their divestment ask. Like the Carbon Underground 200, our equity funds aim to reduce exposure to potential emissions from current fossil fuel reserves of the largest publicly-owned producers to zero.

But we go further. The US and International Core Equity funds we use exceed the standards of the divestment movement by excluding major owners of coal-fired power plants — the #1 problem, say climate experts — and substantially reducing exposure to industrial greenhouse gas emissions.

We also exclude companies involved in factory farming, palm oil production, any other activities that we believe to have negative social value.

Certain information incorporated herein has been provided by Institutional Shareholder Services Inc. (“ISS”) and by MSCI ESG Research Inc. (“ESG”). Although Macroclimate and Dimensional Fund Advisors’ information providers, including without limitation, ESG and its affiliates (the “ESG Parties”), obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy, and/or completeness of any data herein. If you want more information about Dimensional’s ESG criteria, contact us.

And we don’t stop there. In addition to an exclusion strategy, we overweight the most sustainable companies while avoiding those that are average or below average. The consequence of this approach, at the industry level, is to shift capital from companies with the worst sustainability scores toward companies with the best scores.

Why does this matter?

If investors — on a global scale — divert their capital from climate stressors to more climate-resilient alternatives, the risk of abrupt and irreversible climate changes could be reduced in a material way.

While we believe that large scale divestment from fossil fuels and investing in more sustainable alternatives could positively impact climate change, we are not making a claim that your personal investment in these funds alone will directly or materially influence climate change.

1 Source: Dimensional Sustainability Report for US Sustainability Core 1 ETF (data as of June 30, 2025). Weighted Average Potential Emissions from Reserves (from which this reduction in exposure was calculated) is found using a theoretical estimate calculated by MSCI of carbon dioxide produced if a company’s reported reserves of oil, gas, and coal were converted to energy, given estimated carbon and energy densities of the respective reserves, for each portfolio or index company and calculating the weighted average by portfolio or index weight. Potential Emissions from Fossil Fuel Reserves data is provided by third-party data providers, and methodology is subject to change with data developments or other findings or events.

2 Exposure to MACROCLIMATE® 50 — the 50 largest public-company owners of coal power plants in Developed Markets plus China and India — as reported by Fossil Free Funds with data updated 7/30/25 for DFA US Sustainability Core 1 ETF and 7/30/25 for iShares Russell 3000 ETF (IWV). Exposure reduction then calculated by Macroclimate.

3 Source: Dimensional Sustainability Report for US Sustainability Core 1 ETF (data as of June 30, 2025). Weighted Average Carbon Intensity (Industrial Greenhouse Gas Emissions) is found by calculating the recently reported or estimated Scope 1 (direct) + Scope 2 (indirect) greenhouse gas emissions in carbon dioxide equivalents (CO2e) normalized by sales in USD (metric tons CO2e per USD million sales) for each portfolio or index company and calculating the weighted average by portfolio or index weight. Greenhouse gases included are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3).

Exposure to potential greenhouse gas emissions (Tons CO2e / millions sales) by publicly-traded companies).

Carbon Intensity data is provided by third-party data providers, and methodology is subject to change with data developments or other findings or events. Third-party emissions data is available for over 99% of public companies. For companies where data is not available, Dimensional applies a sector average value.

4 Source: Dimensional Sustainability ETF Overview (2024). Considers exposure to publicly-traded companies involved in key activities such as factory farming, palm oil production, child labor, civilian firearms, private prisons, tobacco, and certain weapons.